BEFORE YOU JUMP INTO TODAY’S ISSUE:

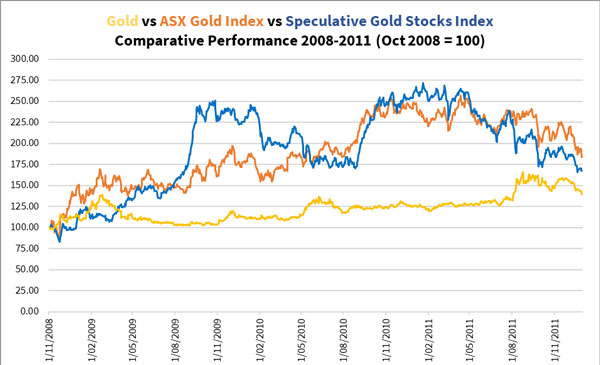

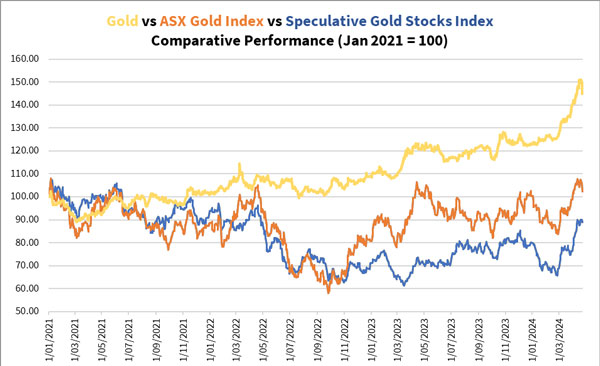

‘The stars are well-aligned for today’s Gold Strike 2024 re-open’, writes Brian Chu…

‘US GDP numbers disappoint, pushing markets to risk-off behaviour.

‘The New York HUI Gold Index jumped 4% overnight.

‘Oil edging down, giving a boost to gold mining industry margins.

‘And our free trade, full buying instructions revealed in this presentation, has broken out of its tight trading range over the last six months.

‘Operating results for March quarter have improved, bringing back buying to the ASX Gold Index, and investors will look at explorers from here.

‘Four of our five priority trades are up since February, four of them have announced capital raising, corporate takeovers and development progress.’

It’s a very exciting time for the gold sector.

Watch Gold Strike ’24 for a limited time here.

***

Dear Reader,

Over the next few weeks, I’m going to focus on THE most important thing to understand when it comes to investing. It’s more important than valuation, company analysis, or mastering the ‘technicals’.

It’s understanding investor psychology, and how your brain plays tricks on you.

Charlie Munger was famous for his multidisciplinary approach to investing. He put understanding psychology up there as one of the most important disciplines for an investor to master.

He was so impressed with the book Persuasion, that he gifted the author, psychologist Robert Cialdini, a share of Berkshire Hathaway.

What I want to do over the next few weeks is give you an understanding of just why your brains works in the way it does in certain circumstances. If you understand the mechanics of the brain when it comes to dealing with investment markets, you might be better able to control its impulses.

Buffett and Munger have long said that they are not particularly intelligent. Rather, they just practice the right temperament for investing.

I would argue that they are very intelligent. But this isn’t their edge. Many intelligent people fail in investing. Their edge is their temperament. They have mastered their emotions.

I’m not saying you can do it too. It’s obviously hard. But understanding how your ‘software’ system works is a good start on the road to being able to program it better.

The simple fact is that the brain has not evolved to deal with investment markets. That’s why so many investors lose when they first start out. Not because they picked the wrong stocks, but because they succumbed to emotional pressures. These pressures are the result of our innate software program that runs in the background.

What is this program?

At a very basic level, I guess you’d call it a survival program. By that I mean social survival. We can’t survive on our own. We need to cooperate to ensure we have adequate shelter, food and water, and clothing. We are, therefore, social creatures. And evolution has ensured we are rewarded for social behaviour.

How?

Our brain releases neurochemicals to reward behaviour that promotes survival. It also releases other neurochemicals to discourage behaviour that threatens our survival (physical or social).

In her book, I, Mammal, Dr Loretta Breuning writes:

‘Humans have a big cortex and a big capacity to learn from experience. But we cannot short circuit our mammalian limbic system. Our cortex gives our limbic system information to make better decisions, but our limbic system still controls the neurochemicals that link mind and body. Our actions ultimately come from our neurochemical selves.’

Fear and greed chemicals

What are these neurochemicals? Let’s call them:

1. Fear (or stress) chemicals, and

2. Greed (or happy) chemicals.

From an investment perspective, these are the chemicals your brain releases (via the limbic system) at extreme highs or lows in individual stocks, or the stock market as a whole. These chemicals override your rational brain and make you do things you later regret.

They make you buy at the top and sell at the bottom. Which is really annoying.

Knowing what these chemicals are, how they work and why, will give your rational brain — your cortex — the best opportunity to override the evolutionary survival impulses fired off by these neurochemicals.

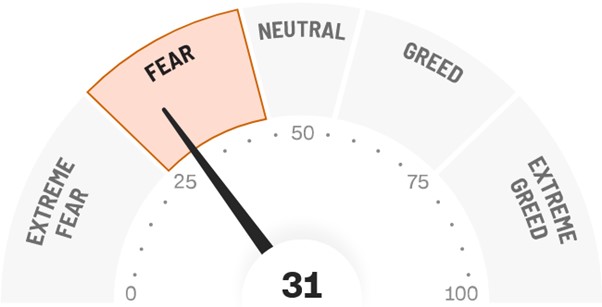

Given that we’ve been in a ‘greed’ phase for the past few months, let’s take a look at how these chemicals work to influence our behaviour. Next week, we’ll examine the effect of fear chemicals.

The greed chemicals are:

- Dopamine

- Serotonin

- Oxytocin

Dopamine: The offer of a big reward

Dopamine is the big one here. Previously, researchers believed that the brain produced dopamine in response to obtaining a reward. Now, it’s thought that dopamine comes from the expectation of a reward. It’s a motivating chemical.

Consider how Dr Loretta Breuning puts it in her book, Habits of a Happy Brain:

‘Our ancestors didn’t know where their next meal was coming from. They constantly scanned their surroundings for something that looked good, and then invested energy in pursuit. Dopamine is at the core of this process. In today’s world, you don’t need to forage for food. But dopamine makes you feel good when you scan your world, find evidence of something that felt good before, and go for it. You are constantly deciding what is worth your effort and when it’s better to conserve your effort. Your dopamine circuits guide that decision.’

Translated to the game of investing, this is what happens in a bull market when you’re planning to buy a stock. You might have already made some gains on a particular stock. If you see a similar situation unfolding in another stock, its potential excites you. That’s the dopamine flowing. It provides the motivation for you to take the risk and place the trade. Motivation = decision = action.

Dopamine especially flows when the reward you get exceeds your expectation. Say you buy a stock expecting steady price appreciation. But a takeover announcement sees it soar 50% instead. At that point, you get a surge of dopamine as a reward and motivation to do it again.

Unfortunately, unexpected rewards are hard to replicate. That’s why they’re unexpected. The craving for dopamine leads you to take increased risks to try and obtain your past investment high. Such a pursuit generally leads to trouble.

I think this is partially why winning streaks typically end in tears. In your attempt to replicate past successes, you often take on riskier bets and replace sound judgement with hope. That never works well.

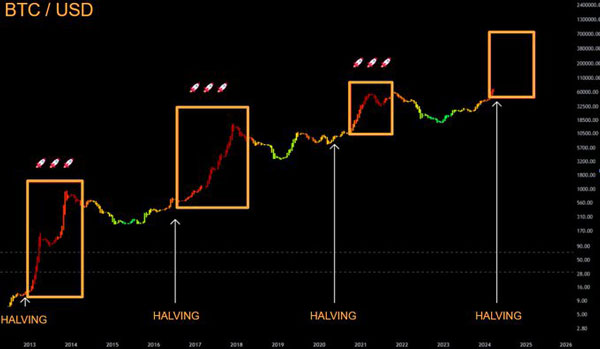

Dopamine has us constantly searching for the next big winner. That’s why people love punting on tiny resource stocks, cryptocurrencies, or tech stocks. The offer of a big reward gives us a dopamine high.

While this is fine if it’s controlled, keep in mind that dangerous habits can form, especially if you’re ‘unlucky’ enough to stumble on some early winners.

Early (and unexpected) winners give you the dopamine rush that you continue to seek out. It can turn into a form of addiction. Consider the following, from Jason Zweig’s, Your Money and Your Brain:

‘At Harvard Medical School, neuroscientist Hans Breiter has compared activity in the brains of cocaine addicts who are expecting to get a fix and people who are expecting to make a profitable financial gamble. The similarity isn’t just striking; it’s chilling. Lay an MRI brain scan of a cocaine addict next to one of somebody who thinks he’s about to make money, and the patterns of neurons firing in the two images are “virtually right on top of each other”, says Breiter.’

That’s why making easy money when you first start out is dangerous. Through the release of brain chemicals, you’re conditioned to think this is the norm. So you continue to chase the feeling by taking bigger and riskier punts.

Serotonin: A swarm of locusts

Serotonin explains why we get sucked into investment fads. It’s another survival-promoting chemical found present in every living thing.

In the animal world, serotonin is released when access to food is secure.

Animals also enjoy a serotonin release when they rank higher in social status. This provides a clue as to how it works with humans and investing.

Dr Loretta Breuning gives a few examples in her book, I, Mammal:

‘In an experiment with an alpha male vervet monkey and his subordinates, researchers placed a one-way mirror between them. The alpha male could see his troop, but they couldn’t see him. During his displays of dominance, the troop didn’t react with its usual deference. After several days of this, the alpha male’s serotonin levels dropped, and his anxiety levels increased.’

Doing better than others in the investment game? Enjoy that sweet flow of serotonin…

And then there is this interesting finding between serotonin and locusts.

‘Serotonin has been found to play a curious role in the behaviour of locusts. A locust generally avoids other locusts, but serotonin transforms them into swarm creatures. Locusts produce serotonin when they get jostled and stimulated by fellow locusts due to overcrowding. Once their serotonin is triggered, they seek each other out, creating a pestilent swarm in pursuit of food. Serotonin makes them sociable when solitary food seeking cannot satisfy their needs.’

It is easy to see the similarities here between swarming locusts and investors (or speculators) swarming around the latest investment fad. Being part of a crowd searching for food (or big returns) makes people feel good. Serotonin is the feel-good chemical.

Because we have evolved to crave this chemical, being part of a crowd feels good. And when you’re invested in a stock or asset class that is doing well, you feel good when you tell others about it. It elevates your social status, if only in your eyes, and if only for a brief time.

Oxytocin: The comfort of crowds

Oxytocin performs a similar, if slightly different, role. It’s the chemical release we get from the comfort of crowds. For example, when a sheep can’t see another member of the flock, it panics and its brain releases cortisol. But when it joins the flock again, the brain produces oxytocin.

Humans (and most types of mammal species) are stronger in groups or herds. That’s why we’ve evolved to live in ever larger groups — it promotes survival. Oxytocin is the neurochemical that provides the feel-good factor to promote this survival.

When you’re invested in an asset class that is flying, you get a buzz about being involved in a ‘community’ of like-minded investors. They’re like you and you’re like them.

You feel good when others agree with you, and you feel good when you read things that you already agree with. It’s why confirmation bias (filtering for information that confirms your existing beliefs) is so pervasive in investment markets. It’s the oxytocin!

Stock exchanges form, bubbles follow

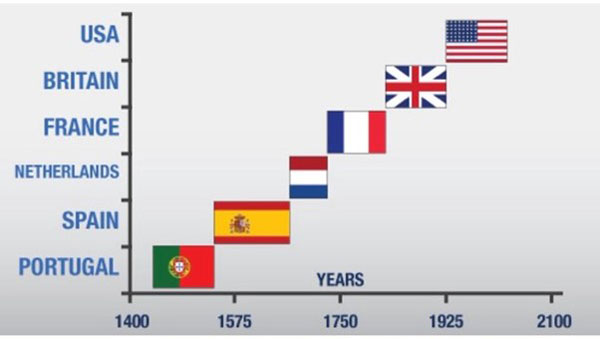

There is evidence that trading in financial instruments took place in the early Italian republics of Florence, Venice and Genoa from the 1300s. However, this didn’t result in the establishment of formal stock exchanges.

The Dutch East India Company formed the first modern stock exchange in Amsterdam in 1602. The aim was to create a place where shares in the company could be traded in a secure and organised manner.

Perhaps not coincidentally, one of the first recorded speculative bubbles took place in the Netherlands, or the United Provinces as it was called at the time, soon after the Amsterdam exchange started operating.

The tulip bubble, or tulip mania as it came to be known, gripped the Dutch population in 1636-37. There were clearly a lot of happy chemicals floating around at the time.

Less than a century later, the South Sea Bubble of 1720 inflated in London. Thousands of speculators joined in, but it was a short-lived party. The bubble soon burst, ruining thousands.

This bubble episode is the source of the well-known quote from Sir Isaac Newton: ‘I can calculate the movement of the stars, but not the madness of men.’

It is not definitively known whether Newton lost money in the bubble or not. He was Master of the Royal Mint at the time and was influential in money matters.

So the quote may be a personal lament, or a response to a question of how far prices can rise.

Whatever the case, the point I’m making is that soon after large-scale trading of financial instruments began, people started succumbing to their emotions.

These emotions evolved over millions of years. They are designed to promote survival in a very different environment to the one that exists in the modern investment world.

In fact, survival in the investment world rewards behaviours that go against our evolutionary instincts!

If you want to be a better investor, then, you have to think and act differently from the investment herd. But being with the herd generates feel-good neurochemicals. That’s why it’s not easy to break away. When you do, you feel vulnerable and threatened. The stress hormones adrenaline and cortisol rise in response to ‘being alone’.

It’s why being bearish in the midst of a bull market or bullish in the depths of a bear market is often described as a ‘lonely’ place to be. It doesn’t feel good.

Even though the rational part of your brain knows that it’s the right place to be, your mammal brain makes it exceedingly difficult for you to occupy this space. It simply goes against your evolutionary wiring.

Next week, I’ll look at how the fear chemicals work their magic on you and make you sell at the low…but only if you let them.

***

As always, send any comments or feedback to letters@fattail.com.au

Regards,

|

Greg Canavan,

Editorial Director, The Insider

|