Mining: Phase One

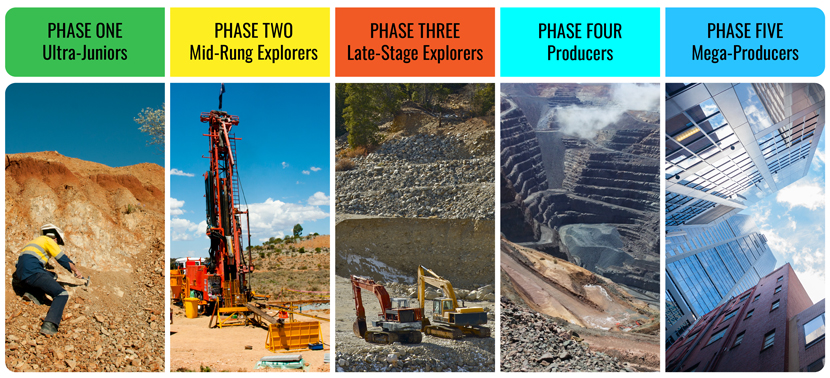

Most people don’t know this, but there are FIVE phases in the lifecycle of an Aussie mining company, as you can see here:

Miners at the ‘mega’ production stage have reached Phase Five. They make up around 1 in 10,000 miners listed on all markets worldwide…

These are the household name producers…your RIOs and BHPs. Diversified conglomerates with revenues in the many billions.

You know these guys…maybe you own shares in them. In normal times, Phase Fivers are relatively boring to invest in. Their big ‘organic’ growth is in the rear-view mirror.

Move down the scale though and things get a bit more interesting…

Phase Four miners are the early and middle-rung producers. Some of these names might ring a bell, too.

Phase Four means you’ve done the hard exploration yards…processing facilities are complete…

And, assuming their explorers have done the business in phase three, they’re producing…and the revenue is flowing.

For most in the industry, it’s happy days if you reach Phase Four!

Now we’re getting closer to James Cooper’s area of expertise: DIGGING and DRILLING. Phase Three miners are late-stage explorers.

They’ve made big discoveries. One final drill-out is usually needed to define the deposit.

Many of the finer issues come into play at this stage, too, such as metallurgy. This is the quality of metal that sits in the ore.

These guys are on the cusp of mining…and progressing to a Phase Four producer. It’s a make-or-break time, though!

Then we start getting to SPECULATION territory. These are Phase Two miners…the mid-rung explorers.

This is where you can start seeing some serious share price fireworks. But it’s also where you can lose a lot of money IF you back the wrong stock.

In Phase Two, management has proven itself. They’ve discovered significant mineralisation on their landholding that has the POTENTIAL to become a mineable ore body.

Then we come to true wildcats in the mining industry…the early explorers.

Or as James calls them: PHASE ONE miners.

These companies have virtually nothing but a piece of land to explore. And if you don’t know the exploration game (from the inside), it can be really hard to see the value.

It’s what makes these companies so risky.

At the earliest stage, it all rests on the geologists. They put their necks…and jobs…on the line. They back educated hunches on where metal deposits are.

Yes, they use things like geochemistry or geophysics to improve the confidence of their theory. But it remains just a theory.

Until they get that very first strike…

There are few greater or quicker gains to be had on the stock market.

It’s these, ultra-high risk mining stocks that James Cooper recommends in Mining: PHASE ONE.

He uses his vast experience as a working geologist, using a personally developed four-point check system to determine the viability of each trade.

This checklist includes:

- Mineralisation density of the explorers tenements

- Proximity to known and proven mines

- The management team

- And cash in the bank

And in fact you can read in more detail a free report on James’s check system here — we want to give all readers access as we believe it will only help you in your resource investing — especially at the more speculative end of the market.

But if you’re looking for trade ideas and guidance from a true professional who’s ‘walked the walk’, check out Mining: PHASE ONE.